E-invoicing 2026: What Every Business Needs to Know About the New Rules

Other

January 25, 2026

Electronic invoicing will now become a reality for all businesses. According to Eurostat data, 67% of EU companies were already using e-invoicing systems in 2023, and by 2025 this figure had reached 80% [9]. However, Hungarian small and medium-sized enterprises are still experiencing problems: 15% of them received fines last year in the NAV online invoicing system [9].

A new rule came into effect on July 1, 2025: energy suppliers can only issue electronic invoices to businesses [6]. From 2028, e-invoicing will be mandatory for all B2B transactions [1]. The goal is simple: faster digitization and more accurate data reporting [6]. The new system requires the use of a structured data format that is suitable for real-time reporting to the tax office [1]. The NAV is also expanding its services, offering new archiving options and an improved, free invoicing program [1].

The practical advantages of e-invoicing are clear: it saves time, money, and effort [9]. This guide contains everything Hungarian entrepreneurs need to know about the changes coming in 2026—from technical details to practical solutions.

New rules for domestic B2B transactions

From January 1, 2025, energy suppliers will only be able to issue e-bills to businesses [1]. Companies, public institutions, local governments—everyone will receive electronic bills. The general public will still need to give their consent [7].

The ViDA package will later extend the obligation to all domestic B2B transactions [6]. All companies will need to know how to issue and receive e-invoices [7].

EU cross-border traffic

From 2028, e-invoicing will also be mandatory for cross-border transactions within the EU [8]. Paper invoices will no longer be an option [9]. In addition, real-time data reporting will also be introduced [8], replacing the current summary statements.

Deadlines: 10 days after fulfillment for international transactions, 8 days for domestic transactions [6].

Paper bill exceptions

Paper-based invoicing is limited to a small group [9]. Remains:

For private individuals (B2C)

For customers outside the EU [6]

Where the Member State expressly permits [9]

But even private individuals can request e-invoices [7]. Practically every business must be prepared for electronic invoicing.

This may be challenging for smaller companies at first, but in the long run it simplifies administration and makes processes more transparent.

Technical Standards: XML, XSD, and PEPPOL Systems

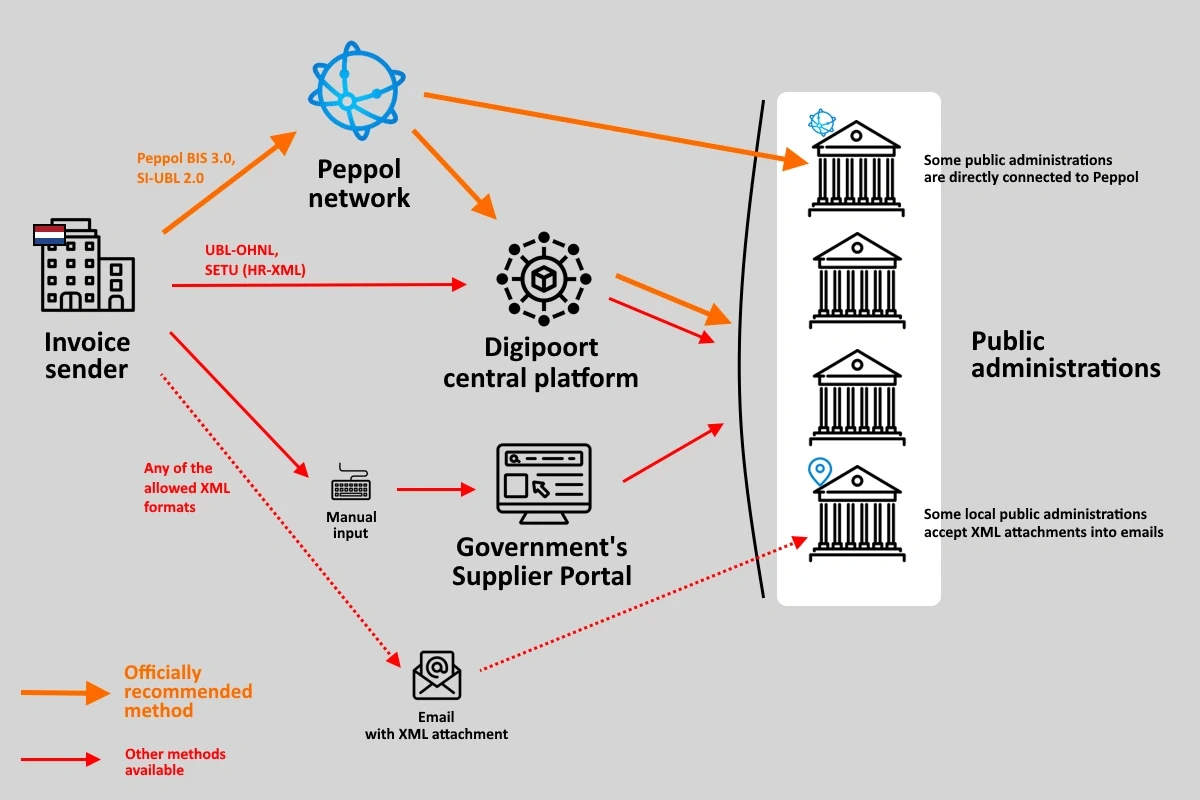

Image Source: The Invoicing Hub

The technical foundations are now becoming truly important. From 2025, all e-invoices will have to comply with strict standards, ensuring interoperability between different systems and effective control by the tax authorities.

EN 16931 Standard: The New XML Requirements

From July 1, all electronic invoices had to comply with the European standard EN 16931 [7]. This means a uniform data structure for all EU member states, which is essential for cross-border business relationships. All invoices must be in XML format and comply with the XSD schema based on the EN 16931 standard [8].

XML format means automatic processing. The time for manual data entry is over. XML (eXtensible Markup Language) is a text document that can be processed automatically by programs [9]. NAV systems will also work this way, with faster and more accurate checks.

PDF+XML Hybrid Invoices End

Many companies still use "hybrid invoicing" – PDF display with XML background. This will be discontinued in 2025 [8]. XML data structure will become mandatory, with PDF remaining only an optional display format [10].

Exception: private individuals can still receive invoices in traditional format [8]. However, simple PDFs that do not contain structured data are no longer considered electronic invoices [11]. XML enables automatic checks before issuance, resulting in fewer errors and fewer problems.

PEPPOL Network: Optional Feature

PEPPOL (Pan-European Public Procurement Online) is an international network for the standardized exchange of electronic documents [12]. It will not be mandatory in Hungary, but it may be useful [8]. It is particularly worthwhile for those whose partners are already PEPPOL members [8].

To connect, you must register at a certified PEPPOL access point [2]. Once you have a unique identifier, you can start sending and receiving documents [2]. Additional benefits include greater efficiency, better quality, and increased security [12].

The NAV does not plan to offer PEPPOL services [8], but companies involved in international trade should seriously consider joining.

Customer data reporting and status report obligations

Mandatory e-invoicing imposes new obligations not only on invoice issuers, but also on buyers. From now on, the NAV will check invoices from both sides.

Introduction of customer-side data reporting

Buyers must report all invoices received within five days [6]. This applies to all domestic and intra-Community transactions. The data to be reported corresponds to the content of the invoice, although less information is required for intra-Community transactions [6].

For domestic transactions, the entire XML file must be sent as customer data reporting [6]. This is simpler for taxpayers, but means stricter controls. Previously, only the M sheet of the VAT return and the A60 form were used for this purpose [8].

Status report: confirmation of economic event

The status report is a new feature of the ViDA package. Here, the buyer indicates which invoices did not represent actual transactions during the VAT reporting period [6]. The report must be submitted together with the VAT return.

If the buyer later acknowledges the transaction, the status report must be corrected immediately [6]. This primarily protects against fictitious invoicing.

Connection to the online invoice NAV system

The NAV Online Invoice system remains the central platform. Data reporting is only valid if the system confirms it [3]. There are three possible responses: OK, warning, or error [3].

Since 2021, almost all invoices must be reported, even those issued to private individuals and foreigners [4]. The system's validations are constantly changing—three new WARN messages were recently added, and three were removed [13].

Accreditation of invoicing programs and the new role of the National Tax and Customs Administration

One important element of the changes coming in 2025 is the accreditation of invoicing programs. This will completely change current invoicing methods. From 2025, the NAV will monitor invoicing systems more strictly.

Technical Check Before Invoice Issuance

Invoicing programs are required to check the technical compliance of invoices before they are issued. During the check, it is necessary to ensure that all mandatory data required by the VAT Act is included, that the tax number of the domestic taxpayer customer is verified, and that the data is recorded in the correct data structure [6]. If the pre-check finds an error, the invoice cannot be issued [8]. It is recommended to check the validity of the XML file against the relevant schema before closing the invoice [14].

Accreditation Requirements for Developers

The plan was that from 2025 onwards, invoices could only be issued using accredited invoicing software [8]. However, this is now expected to be introduced in 2026. The accreditation process examines whether the software is capable of generating appropriate XML invoices and filtering out incorrect data [6]. If data reporting using non-accredited software remains in 'pending' status for 30 days and accreditation is not granted during this period, the taxpayer will be subject to a default penalty [6]. The tax authority may revoke accreditation if the program regularly allows incorrect invoices to be issued [6].

NAV Free E-invoicing System

The NAV provides a free invoicing program for businesses in order to reduce administrative burdens [15]. The Online Invoicing program is constantly evolving and is also available via a mobile app [5]. The program assists users in issuing invoices with prompts and warnings, and automatically fulfills data reporting obligations [5]. The NAV also provides long-term storage of electronic invoices free of charge [5].

Summary

The introduction of e-invoicing in 2025 will affect all Hungarian businesses. The aim of the changes is simple: more transparent taxation and less tax evasion.

Key dates:

January 1, 2025: Mandatory e-billing for energy suppliers

July 1, 2025: Introduction of EN 16931 standard

2028: Mandatory e-invoicing for cross-border EU transactions

The technical side is crucial: XML format will be mandatory, and PDF+XML hybrid solutions will disappear. Customer data reporting will become a new obligation with a 5-day deadline.

From 2025, it will not be possible to issue invoices without accreditation for invoicing programs. Those who do not have the appropriate software can use the NAV's free program.

The initial transition requires work, but administration will become simpler later on. It is worth starting preparations now so that everything will be in order by 2025.

References

[1] - https://www.logzi.com/blog/modern-szamlazas-es-jogszabalyi-megfeleloseg-a-kkv-k-utja-az-elonyhoz-es-biztonsaghoz-151

[2] - https://konyveloiklub.hu/index.php?page=cikk&id=4457

[3] - https://www.bdo.hu/hu-hu/aktualitasok-blog/szakmai-hirek/vida-csomag-magyarorszagon

[4] - https://www.billingo.hu/tudastar/olvas/e-szamla-e-szamlazas-minden-amit-vallalkozokent-2025-ben-tudni-erdemes

[5] - https://www.cmfx.hu/2024/12/12/kotelezo-elektronikus-szamlazas-2025-tol-a-legfontosabb-tudnivalok/

[6] - https://www.szamlazz.hu/blog/2025/05/a-kotelezo-elektronikus-szamlazas-es-archivalas-szabalyai-2025-julius-1-tol/

[7] - https://nav.gov.hu/pfile/file?path=/vida/koncepcio/2025_NAV_ViDA_implementacio_web_kiadvany.pdf1

[8] - https://www.szamlazz.hu/blog/2025/11/czondor-szabolcs-mit-hoz-a-vida-a-magyar-vallalkozasoknak/

[9] - https://ado.hu/ado/eu-kotelezo-lesz-az-e-szamlazas-a-hataron-atnyulo-tranzakciokrol/

[10] - https://www.rsm.hu/blog/2023/eszamlazas/elektronikus-szamlazas-uj-szabalyok-es-kovetelmenyek-2024-tol

[11] - https://kondor-group.com/adopercek-kotelezo-lesz-az-e-szamlazas/

[12] - https://afaklub.hu/?menu=cikk&id=4665

[13] - https://www.rsm.hu/kisokos/nav-xml/xsd

[14] - https://ado.hu/ado/vida-csomag-magyarorszagon/

[15] - https://www.azadotanacsado.hu/2023/03/24/az-elektronikus-szamlazas-jovoje-vege-a-pdf-szamlazasnak/

[16] - https://www.elo.com/hu-hu/digitalizacio/fokusz/peppol.html

[17] - https://unifiedpost.hu/blog/peppol-szamlazas-utmutato/

[18] - https://nav.gov.hu/pfile/file?path=/kiadvanyok/adovilag/adovilag_2018/ld_ADOVILAG_2018/Sinkane_dr._Csendes_Agnes_-_Mit_kell_tudni_az_online_szamla_adatszolgaltatasrol

[19] - https://www.szamlazz.hu/nav-online-szamlazas-regisztracios-segedlet/

[20] - https://nav.gov.hu/ado/egyeb/Modosulnak_az_Online_Szamla_rendszer_validacioi

[21] - https://nav.gov.hu/pfile/file?path=/ado/afa/Szamlazo_Fejlesztoi_Ajanlas_v1.0

[22] - https://adovilag.hu/2025/04/24/hogyan-hasznalhato-es-mire-alkalmas-a-nav-online-szamlazo-programja/

[23] - https://nav.gov.hu/pfile/file?path=/kiadvanyok/adovilag/adovilag-2022/szaraz-tunde---a-nav-online-szamlazo-programjanak-alkalmazasara-vonatkozo-hasznos-tudnivalok